I thought it was time I updated my near decade long time series chart of eastern states average monthly electricity prices from AEMO. I have not been paying much attention to power prices lately but had a general impression Govt. was gloating that prices were low. I have annotated my 9.2 year chart with data added to 15Mar22 For full size chart.

My impression from TV news was that the Fed Govt. was pleased prices were still low. This impression is confirmed by the latest media from Energy Minister Angus Taylor which relies on an ACCC report to say “The ACCC’s latest report shows electricity costs for households are now at their lowest levels in eight years.” Prices have firmed since the ACCC report “Household electricity bills increased in 2020 but are now expected to fall 24June 2021” I wonder if the economy is improving and increasing power demand after the worst of the Covid power demand depression. Time will tell.

>” … if the economy is improving and increasing power demand”

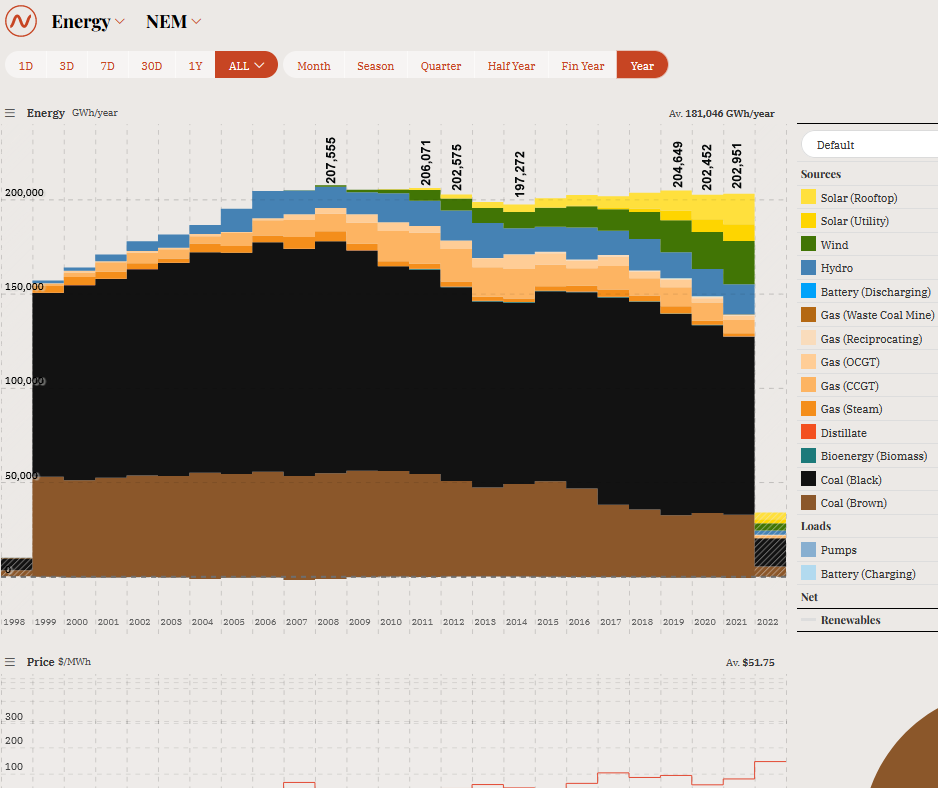

National power demand has been falling for well over 5 years now. The covid years exacerbated it and the trend is not purely linear, but nonetheless is obvious when examined systematically.

My source for this statement is anero.id/energy, examined on an almost daily basis. Loss of both manufacturing and heavy industry (eg. smelters, refineries) seems to me the most likely cause.

We note that the covid years starkly revealed the China-dependent supply line that Aus now helplessly relies on. While the more excitable of the talking heads in the MSM carry on about “rebuilding capability”, no one has offered to re-capitalise this. Not a surprise of course – now after the May election, watch Albanese use tax money to pick “winners”.

Screen save from OpenNem with annual demand annotated. So demand increased through Howard years. Peaked in 2008 then plateaued through Labor years and decreased until carbon tax was repealed in 2014. Then in LNP years has increased a bit to peak in 2019 before the Great Covid Demand Depression. My point about late 2021-2022 to date is the AEMO wholesale prices are hinting at demand returning. Demand needs to average 17,000 GWh a month to get back to 2019 demand. Larger chart

Wholesale prices are meaningless as they do not include the cost of Large Scale Generation Certificates (LSGC’s) energy suppliers are forced to purchase and include in their retail price, nor do they include the supply charge (daily charge levied on supply of electricity to residences, currently around $1.00 – $1.30/day).

They put this misleading propaganda up in the hope that the majority will not notice the relevant information which has not been included.

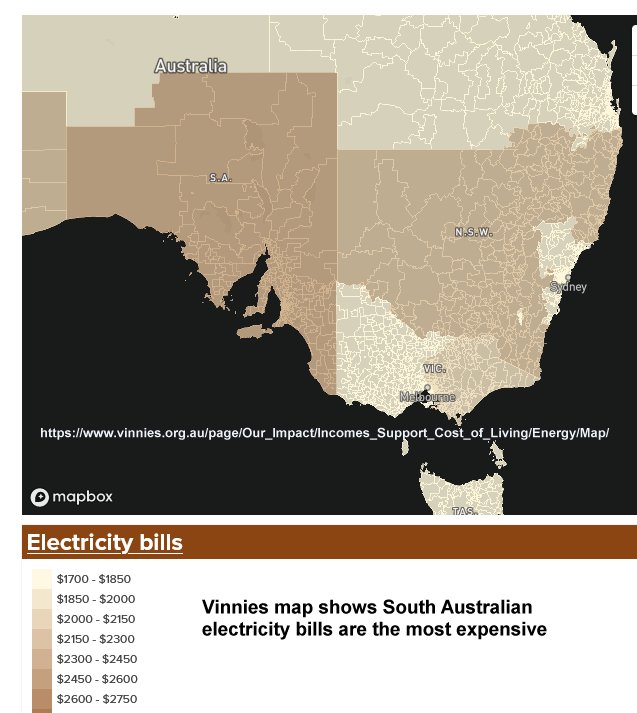

Vinnies is the best source of electricity bill comparisons I have found. Shows SA has the most expensive retail bills. Large map.

Energy dot gov dot au portrays various data but little on retail state by state power bills.

I am a very selfish person who only thinks of himself. Many of my friends and associates are the same.

Occasionally we discuss our own electricity prices.

Without exception they have risen consistently for the past 20+ years.

At my current place of abode, the supplier says the unit price is 21.4c/Kwh. When you throw in the daily service charge and management fees, the TRUE cost comes in at 39.5c/Kwh. Real German stuff.

The daily management fees and service fees are just smoke and mirrors and the statements about decreasing power prices are just horseshit..

wazz Just updated the chart through 31st March Click for full size version – sorry no time to annotate

The March price rises carry on. Not a good time lately for renewables spruikers claims that renewables are/will be reducing prices.

First we have prices firming when they should be seasonaly easing.

Second we have the Alinta Boss Mr Dimery amazing quotes after residents near the Bald Hills windfarm had notable win in a Vic court getting big damages and a requirement that the windfarm must reduce noise at night.

Our GreenLeft ABC reports –

Alinta says court wind farm ruling will have ‘dramatic’ and chilling effect on renewable energy investment 25Mar22

www.abc.net.au/news/2022-03-25/chill-winds-for-renewable-sector/100940308

Alinta chief executive Jeff Dimery says – quote [“I think the magnitude of what needs to be achieved has absolutely been underestimated,” he said. “The narrative around what can be done and how it can be done, in my opinion, is being oversimplified to the community. “There’s a misconception that bringing more and more renewable energy into the market will reduce power prices over time.”]

Note!!! “There’s a misconception that bringing more and more renewable energy into the market will reduce power prices over time.”

Third we have Prof Macintosh absolutely roasting the Feds carbon farming efforts.

Expert Professor shreds Fed Gov carbon farming operation

www.warwickhughes.com/blog/?p=6893

AEMO wholesale daily prices are going ballistic for the first 6 days of April. Check the Average Prices TAB

What is causing this? Are AEMO prices reflecting thermal coal spot prices?

Dunno

aemo.com.au/Energy-systems/Electricity/National-Electricity-Market-NEM/Data-NEM/Data-Dashboard-NEM

The price explosion is full on (unprecedented April prices over last 9 yrs) for the first 8 days of April click for chart.

Open NEM is interesting to click through the states from the north. There seems a clear sign of an attempt to cap prices @ $300. Could the price explosion be due to coal prices? We know from News Media that NSW generators Liddell and Eraring are slated for early closing. ABC reports that Fed Minister Taylor is “seething” when Origin Energy announced the closure of Australia’s largest coal-fired power plant, Eraring, without first notifying the government.

IMHO anybody who thinks Eraring and Liddell generation can be replaced in 3.5 years is smoking some very strong weed. The Fed Gov should buy/resume both Eraring and Liddell to make sure they are run properly and not run down or closed until adequate replacement generation is in place.