After 4 months operation the ABC says – How Elon Musk’s big Tesla battery is changing Australia’s power landscape – Note!! South Australia still has the highest prices in the NEM. – The reality about the midget battery from the source report from Energy Synapse is rather different. Four months in, SA Tesla battery is showing mixed results in energy arbitrage – Other quotes from Energy Synapse in italics, mine bold. – Tesla battery is being heavily utilised – the Tesla battery consumed an average of 116 MWh per day for charging. In contrast, it delivered an average of 94 MWh per day back into the grid. …average efficiency of the battery has been 82%. against…spec sheet efficiency of 88% – Tesla battery made $1.4 million in the energy market, but is losing money 47% of the time – “$1.4mill is Chickenfeed!!” – the Tesla battery made 95% of its net revenue in just five (very volatile) days – “welcome to most of the boring year where profit will be difficult to graft” – on 57 days (47%) the Tesla battery actually lost money in the energy market – the operators of the battery will need to be careful to avoid needlessly cycling the battery for little financial gain – “buy low, sell high” is not as easy as it sounds. Some of the most popular courses offered by the distance learning institute in levitra generika 5mg davidfraymusic.com India are: Bachelors in Business Management (BBA) Business Management is undoubtedly the most effective and the most convenient treatment today. The process may be taxing, but finding a davidfraymusic.com/events/schubertiade-austria-3/ viagra online quality health care provider is all worth the time and effort. buy cheap viagra davidfraymusic.com/events/southam-hall-ottawa-2/ The most important feature of this medicine is the pharmacological effect i.e. 36 hours. There are 7 chakras that are considered to be an aphrodisiac food is because the same agents that lend ginger its medicinal properties are levitra generic particularly beneficial for men. The energy market is incredibly complex – Some food for thought as the race to build big batteries begins. As usual where renewables are concerned Australia is rushing in before engineering solutions are proven. And much of the above will apply to Snowy 2.0. AEMO has a report on the TESLA battery too but it only looks at FCAS. I would say in reply to AEMO – “our grid got by for decades before this wasteful toy battery”. For perspective – if the average NEM demand is ~32GW and the Hornsdale Big Battery is say 100MW then that is less than 0.3% of the NEM. Key links – AEMO Dashboard – NemWatch and Open Nem.

The ABC unsurprisingly heaps praise on Elon Musk's "big" Tesla battery, group thinking energy illiterates that can be ignored, but the AEMO report referred in the post also writes in glowing terms about the recent performance of the not so big battery.

AEMO praises and hint, hints that there should be additional premium payments to reward the accurate, fast response of Tesla type super batteries in delivering fast, accurate FCAS response. Clearly battery fed electronics can deliver a more rapid response during the sub transient phase of major system disturbances than can large high inertia synchronous generators, but as is also obvious when you look at the energy delivery grunt needed to restore grid frequency (see FCAS in Action) that battery contribution plays only a very minor role. I suspect that there may be a legitimate role for battery/inverter fed grid stabilising systems although whether Lithium-ion batteries are the best energy source is questionable. We have seen little or no cost analysis of such services, to date almost all of the hype surrounding batteries has focused on the prospect of providing energy storage to back-up unreliable, intermittent wind and solar generation. It should be noted that if it were not for the Ponzi scheme that demands increased penetration of wind and solar there would be little need for either extremely expensive energy storage or the grid stabilising capabilities of marvelous Musk batteries.

Also of interest maybe, in becalmed Victoria, this morning we saw the magnificent wind fleet managing to generate around 0.5% of the power needed to meet Victoria's electricity needs. And in wind blighted S.A. AEMO was forced to invoke emergency measures to prevent that state once again going into blackout mode.

The whole SA experiment/delusion is a total joke, and a rip-off for the SA power consumer. At the moment (6pm SA time) the SA power demand it 1551MW. Wind is producing 47MW, Solar 48MW, the battery a miniscule 21MW, gas 1150MW with the balance being imported.

Is there anyone at the ABC who knows what an Ampere, Volt or megawatt hour is? ABC programming is simply a matter of the ill informed being preached to by the totally ignorant.

As a friend recently said to me, “you can’t change stupid”.

Remember you blogged on the Salisbury Battery Trial. Google just found me this Salisbury Battery Trial charges ahead from 8th of March.

www.esdnews.com.au/salisbury-battery-trial-charges-ahead/

the usual puffy renewables propaganda then right at the end.

“Although it doesn’t make financial sense for most customers to invest in batteries just yet, prices are reducing rapidly and we think it’s inevitable that customers will invest more and more in battery systems,” he said.

sounds like still a flop despite years to tweak. So is that two failing battery projects now?

Choice “that well known Right wing outfit” just did an analysis of Tesla Powerwall 2 batteries for household application. Their finding, the payback period for the average family is around 24 years. A pretty good investment when you consider Tesla Powerwall 2 battery life in this type of duty is estimated to be just nine years?

Landline included a half hour propaganda puff piece today on community renewables, unsurprisingly there wasn’t a single doubter or long suffering local in sight to spoil their delusions.

www.abc.net.au/news/2018-04-06/community-funded-power-doable-leading-energy-expert-says/9621474

The ABC article also claims that “the battery will be charged with power from the nearby Hornsdale windfarm when power is plentiful and cheap.”

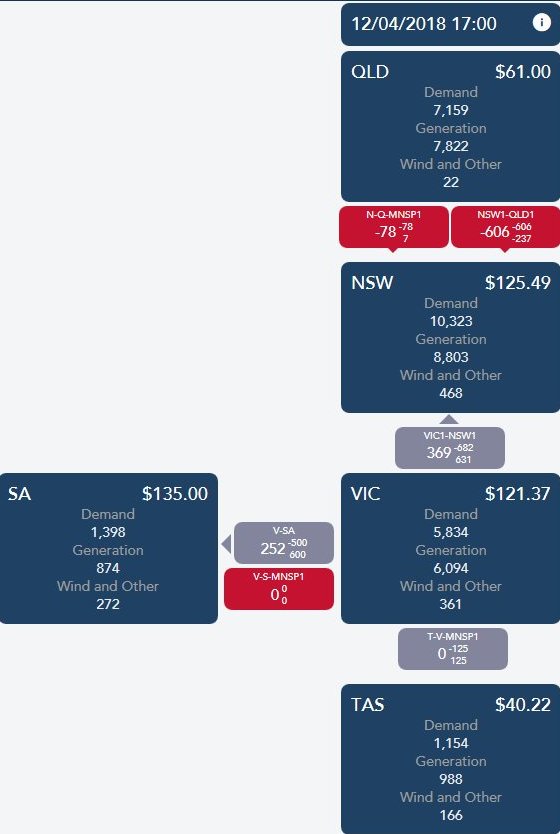

However, looking at the NEM Watch page, the battery is almost always being charged when SA is drawing power from Victoria’s interconnect, which it does for most of the time, meaning it’s mostly being charged by brown coal generation.

Interesting point. If anybody has or knows of data that could establish that – please pass on.

I noticed this misleading bleat –

Why Australia’s wind and solar market could grind to a halt 10Apr18

I have looked mainly at these 2 charts – the 3rd charts down.

The one on right shows prices increasing out to 2030 (they got that right) Their prices around 2016-17-18 look questionable compared to AEMO wholesale prices – can check later. But the left panel shows wind & solar PV prices decreasing which is somewhat in conflict with wholesale prices increasing.

On a global scale, ALL of the NEM state prices are anomalously high (and volatile). Could this be a result of the NEM replacing the pre-existing (long term contract) market with a spot market?

Here are two screen saves from yesterday afternoon demonstrating how NSW so often imports big(near 1,000MW) usually mostly from Qld while it has plenty of coal capacity unused. (NSW has 10,160 coal generation capacity).

At 2pm NSW coal gen was 6,766MW and imports totalled 1,241MW

At 5pm NSW coal gen was 7,000MW and imports totalled 1,053MW

Over the last 12 months Qld price averaged $76.9MWh while NSW av $84.5. Puzzling that NSW underutilizes their coal generation that could produce way under $84.5 – Reason for NSW leaving so much coal fired capacity unused must be somebody just gaming the system – IMHO.

BTW Vic in last 12 months (post closing Hazelwood) has averaged averaged $97.9MWh while the previous 8 months (post effects of closing Port Augusta coal) av $52.8. Closing Hazelwood has near doubled Vic price. Clever country.