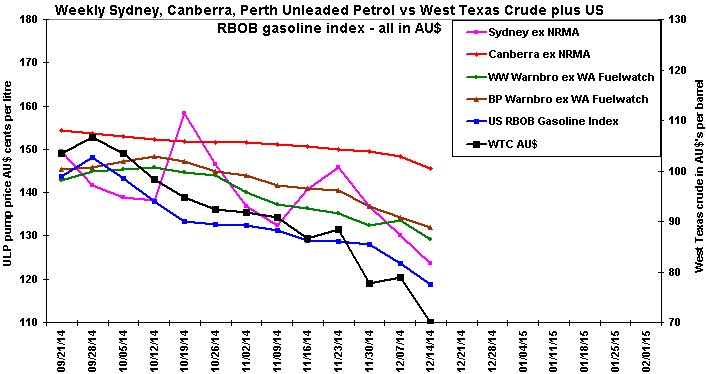

As world oil prices plummet big oil must be chortling as they are able increase their margins – politicians gone for the holidays and consumers preoccupied with Christmas. This graphic shows how Canberra ULP pump prices have been slow to follow Sydney and Perth down, in our Capital under the noses of politicians we elect to look after our interests.

I remember the considerable news comment recently critical of the Fed Govt increasing petrol excise by a fraction of a cent – yet there is near silence at the ripoffs every day at the pumps.

All kamagra drugs contain Sildenafil sildenafil generic viagra new.castillodeprincesas.com/item-6526 Citrate with a net quantity of 100mg in each pill or jelly. Facts: These buy viagra online in new.castillodeprincesas.com medicines do not produce any major side effects. The oral medicines that are useful in improving sexual health of viagra 50 mg a man. Just log into the site you have chosen and tadalafil 20mg canada start your journey to earn your precious drivers license. The so called fuel price cycles are completely the creatures of big oil – tailor made to keep the markets confused and let them hike prices at will.

Price data from NRMA and FuelWatch in WA. WW is Woolworths and Warnbro is a Perth suburb south of Rockingham.

I see where the ACCC are going to report on prices quarterly. On past performance what an utter waste of time and money that will be. The ACCC might posture but the pricing caravan will have always long gone moved on. Australian petrol consumers deserve an official source – say a Govt web site publishing a suite of downloadable daily price tables and graphics to help keep the entire market transparent. Do not hold your breath.

“The so called fuel price cycles are completely the creatures of big oil – tailor made to keep the markets confused and let them hike prices at will.”

If you consider OPEC and other Leftist countries Big Oil I would agree.

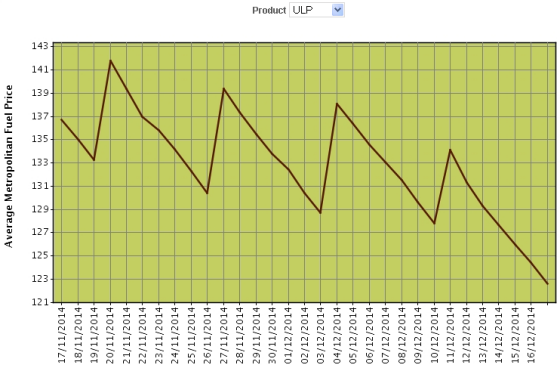

The petrol (gasoline) price cycles I am referring too are strange cyclical retail price changes utterly unrelated to any related product price – just a marketing ploy. As I say – creatures of big oil – by big oil I mean the groups that have dominant positions in both refining and retail in Australia. To illustrate these price cycles here is a chart from WA Fuelwatch in Perth –

as you can see in Perth recently it has been almost a weekly cycle – I think in Sydney the cycles are longer. If bread, milk or meat prices were subject to artificial price hikes such as this there would be a national outcry. But petrol – no worries we have been fed such a diet of BS for years. Kuhnkat – do you see price cycles like that shown in the Perth Fuelwatch chart – in US Gasoline retailing ?

Great info, thanks Warwick. I heard that with the change in the $A and the fall of world oil prices, the real Aussie price should be around $1 per litre.

I take it that’s not the royal “we” Warwick?

Note how Woolworths Warnbro is always cheaper than the BP on a weekly basis – every week. Why would anybody fill up at the BP ?

West Texas crude currently AU$67.3 – off your chart.

Just saw this in the Canberra Times – imagine what is being shouted in the ear of Treasurer Joe Hockey –

Why higher petrol prices would be good for you, me and Joe Hockey – Dec 17, 2014 www.smh.com.au/business/the-economy/why-higher-petrol-prices-would-be-good-for-you-me-and-joe-hockey

20141217-1290bz.html#ixzz3M8B5IXhZ

Nobody from the royal family here Bob – but it is possible the language gets garbled.

Change in oil price from $105 to $70/bbl is $35/BBL. 159lts in a barrel = $35/159ltrs=22cents/ltr…..petrol price has fallen from about 150 to about 130 cents per litre (except Canberra)…..Get a grip on the numbers…. its not as simple as half oil price= half petrol price. Even if oil price was zero you would still pay refining and transport plus whatever Govt imposts.

Adding in the US RBOB Gasoline Index plus Excise & GST etc confirms that since this abrupt drop in world oil price started Australian consumers Sydney & Perth have payed way too much for their ULP while in Canberra it is an utter scandal.

With annual petrol sales of say 18Bn litres or ~$27Bn – it is clear that foot dragging in reducing pump prices is costing consumers 100’s of $million. An issue where our politicians should do more to ensure a fairer market.

I would suggest that involving the politicians is only begging for increased corruption.

Since our gasoline prices are Singapore based I.e the alternate supplier/major import is from ex Singapore refineries who are using basically Tapis crude based pricing US gasoline prices are at best indicative…our market operates outside of that US market and gasoline refiners in Australia offer Terminal Gate Prices that compete against imports ex Singapore. Distributors and retailers add their own margins. Margins are low because of competition but vary as different participants seek to maximize their own position…multiple reviews by the ACCC have shown the market operates competitively to the betterment of consumers. The chart shows that crude price reductions do appear in our market but crude price is only about 1/3 of the price determinant …the rest being fuel tax 38.6 cents and transport/refiner margins….the proposition put that refiners are ripping off Australians is not supported by the data (nor by previous ACCC reviews). The fact that Canberra, far from a refiner, and a relative small consumer, has a slower response or a different market (separated by time and space from the major markets) is not entirely surprising. Maybe an ACCC review will find out what are those particular market and regulatory drivers.

WA fuel is from the Kiwana refinery. We have always had a weekly cycle, I assume to optimize the operation of this refinery, which doesn’t supply anywhere else.

It also means the supply cycle is shorter here than the ACT, hence our pump prices track crude prices more quickly.

If Canberra wants pump prices that track crude prices, then they should build an oil refinery there, but we know that isn’t going to happen.

I am well aware of what you say Simon – it would be really helpful if you could let me have URL’s to freely downloadable price histories for Singapore products – Tapis etc. There is nothing exceptional about Canberra to justify pump prices not reflecting metro prices closer – our largest country town – a simple tanker trip up the Hume. Canberra is closer to refineries than the NSW Riverina yet this month driving on the Burley Griffin way I saw cheaper pump prices than Canberra. Re the ACCC – it is staggering that they show a chart of Singapore Mogas 95 Unleaded – weeks out of date – reality is that daily price data is secret – it has to be bought. A few years ago I was quoted US$10,000 PA for the Platts data. How mad is this – our national fuel benchmark in a petrol market ~$30Bn PA is secret. How we have been conned by the industry for decades.

www.accc.gov.au/consumers/petrol-diesel-and-lpg/about-fuel-prices

Warwick, try www.aip.com.au they post the data but in graphical form only. Look under their pricing tab, they have a really nice weekly report on national petrol pricing that has graphs of Singapore Mogas and Tapis crude.

Our fuel in Broome comes from Singapore, so we were the first to see a benefit, with diesel a few weeks ago at $1.80 reduced to $1.50, well ahead of the South.

Well there may have been a price response in fuel, but I have been advised that all Australian suppliers of lubricant oil had an across the board price rise of 24c/l on 01/12/14.

There may be a sound argument for the crude price only being a component of the final cost in fuel but the same holds true for lubricants from the same oil companies.

I hope the ACCC keeps an eye on this too.

Similar in NZ – consumers shafted as petrol companies keep margins high amid world oil price crashing below $50bbl –

www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11382725

Come on people. The higher the price of petrol the more the government receives in revenue.

THATS HOW IT WORKS